Health

The Excise Tax on High-Cost Health Plans

“Impact of Workplace Wellness-Program Participation on Medication Adherence,” and “Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households”

Wellness Programs: Workplace wellness programs appear to have a bigger impact on medication adherence for some diseases than others, according to new research from EBRI. Press release.

Single/Couple Households: Older singles and older couples tend to face sharply different out-of-pocket expenses for non-recurring health care services such as home health care, nursing home stays, overnight hospital stays, and outpatient surgery—possibly because they do not have a spouse to help as caregivers, according to new research by EBRI. Press release.

“The Effect of the Current Population Survey Redesign on Retirement-Plan Participation Estimates,” and “Worker Opinions About Employee Benefits: Differences Among Millennials, Baby Boomers, and Generation X Have Implications for Plan Sponsors”

CPS: Estimates from the new and redesigned Current Population Survey (CPS) by the U.S. Census Bureau show a drop in the percentage of Americans who participate in a workplace retirement plan. However, the results raise doubts about the use of CPS data to assess current and future retirement plan coverage policies, according to a new analysis by EBRI. Press release.

Generational Views of Benefits: Compared to their older cohorts, Millennial workers are less interested and knowledgeable about their work place benefits, and prefer life insurance over health insurance, according to a new analysis by EBRI. Press release.

Findings from the 2015 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey

'Views on the Value of Voluntary Workplace Benefits: Findings from the 2015 Health and Voluntary Workplace Benefits Survey,' and 'Evidence on Defined Contribution Health and Retirement Benefits: The Road Ahead'

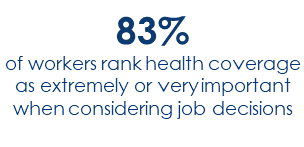

Benefits Survey: More than three-quarters of American workers say their workplace benefits package is important to their decision to take or reject a job, according to new research by EBRI and Greenwald & Associates. Press release.

DC Benefits: Private-sector retirement benefits have long been dominated by “defined contribution” plans funded primarily by workers’ own contributions. Private-sector health benefits are still funded primarily by employers, but that may be starting to change with the advent of “defined contribution” health plans. This has major implications for the American work force, the U.S. health care system, and even economic security in the nation, which were explored at EBRI’s 76th policy forum held in Washington this spring. Press release.

“Amount of Savings Needed for Health Expenses for People Eligible for Medicare: Unlike the Last Few Years, the News Is Not Good,” and “How Does the Probability of a “Successful” Retirement Differ Between Participants in Final-Average Defined Benefit ..

Retiree health savings: Projected savings targets needed to cover health care in retirement are going up again after several years of decline, according to new research by EBRI. This follows more recent declines during 2012-2014.

DB-DC: Does a traditional “defined benefit” pension provide greater retirement security than a “defined contribution” 401(k)-type plan? The complicated answer to that simple question depends on your salary level and the level of pre-retirement income to be replaced, according to a new analysis by EBRI.

Sources of Health Insurance Coverage: A Look at Changes Between 2013 and 2014 from the March 2014 and 2015 Current Population Survey

'2015 EBRI/Greenwald & Associates Health and Voluntary Workplace Benefits Survey: Most Workers Continue to Give Low Ratings to Health Care System, but Declining Number Report Health Care Cost Increases,' and 'IRA Asset Allocation, 2013, and Longitudi ..

WBS: Significantly fewer workers say they experienced health care cost increases in 2015 compared with previous years, according to new research by EBRI. Press release.

IRAs: Owners of individual retirement accounts (IRAs) significantly increased their investment allocations to stock equities in 2013 compared with the two previous years, according to new analysis by EBRI. Press release.